The summer is in full swing, Searchmetrics is releasing its new Travel Industry Ranking Factors report, and planes, trains and automobiles are on many consumers’ minds. So it seems that now would be as good a time as any to take a crack at Unwrapping the Secrets of SEO for travel aggregator websites such as TripAdvisor, Yelp and Booking.com.

In a previous article, I pointed earlier this year to major visibility shifts in the travel industry. TripAdvisor, with its smorgasbord of reviews, recommendations and price-comparison tools, had been gaining ascendancy over Yelp and Booking.com. Taking a snapshot now of those same players, Yelp is making headway in trying to become a major one-stop shop for the 60 percent of travelers who now search online before booking a trip. But since those two providers were the focus of my last post, this one centers on booking.com, which has seen its visibility skyrocket nearly 100 percent in the past year!

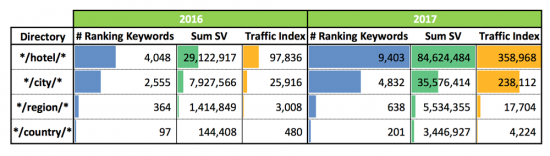

A quick analysis of this improvement shows that change could be easy for many travel-industry outfits. For booking.com, with its focus more squarely on transactional travel, its biggest increase came thanks to the /hotel/ (URLs related to specific hotels) & /city/ (URLs related to hotels in specific cities) directories.

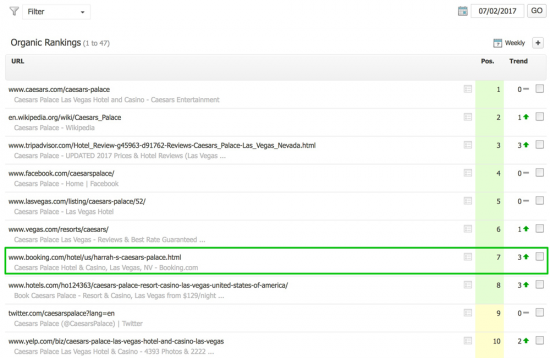

What’s really impressive is how they currently manage to rank alongside local website hotels, Facebook and Wikipedia. In the following chart, you’ll see Wikipedia and TripAdvisor rank as well as you might expect for their big brands against Caesar’s Palace, but booking.com takes seventh place:

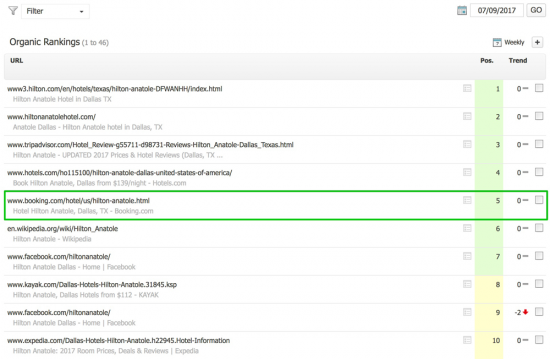

And for “Hilton Anatole”:

What could have triggered this huge increase? I’ve followed the ups and downs of many of these sites for months, but I’m not aware of any major redesigns that took place at booking.com. Sure, some of its landing pages have undergone small makeovers, with title changes, new above-the-fold content and additional links here and there (which the new ranking factors report suggests will increase visibility).

If you compare pages for Key West vs. Key West page from 2016, you should be able to notice those subtle changes. But while such implementations clearly have a positive impact, they are probably not the most important contributors to booking.com’s visibility increase.

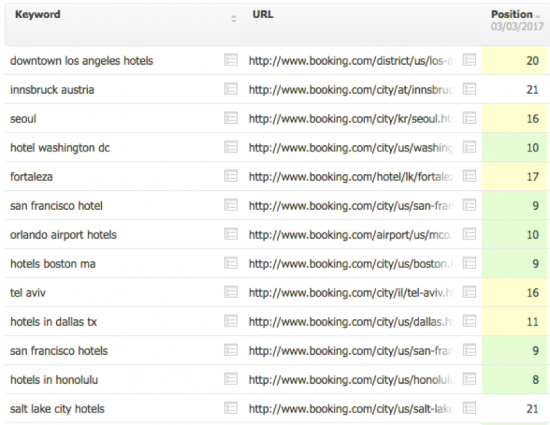

My conclusion? Booking.com is benefitting mostly from its migration to HTTPS security. This is what we consider a core, or indirect, ranking factor. Search engines increasing are showing preference to sites with HTTPS security because it signals a great trust against fraud and other bad stuff online. If you looked at Booking.com on March 3, you’d find all its web pages are HTTP.

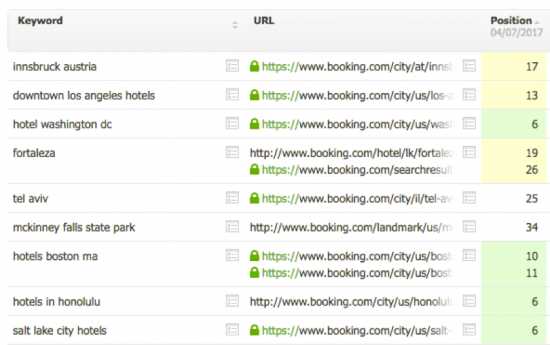

Beginning April 7, however, you’ll notice the conversion to HTTPS had begun: This correlates with their 2017 increase:

This correlates with the 2017 visibility jump:

Aside from content improvement or any technical SEO changes, booking.com simply may be becoming more of an authority with search engines over other sites, including hotel brands.

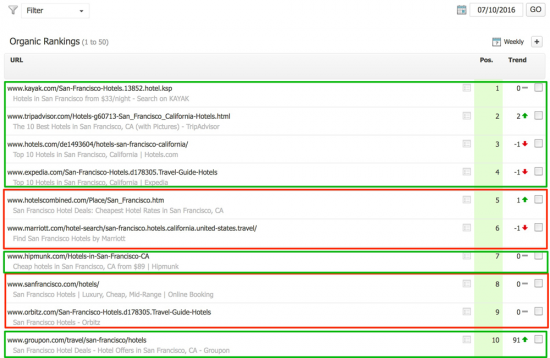

Using data from our Research Cloud, comparing July 2016 vs. July 2017 rankings, I’ve picked out a few keywords where booking.com is currently doing very well compared to 2016. Many sites such as expedia, kayak and hotels.com are still around, however some major brands have recently been pushed out of the SERPs. Take a look at this search for “San Francisco hotels”, focusing on Marriott and Hilton, two of the most-recognized hotel brands around the world. Here’s 2016:

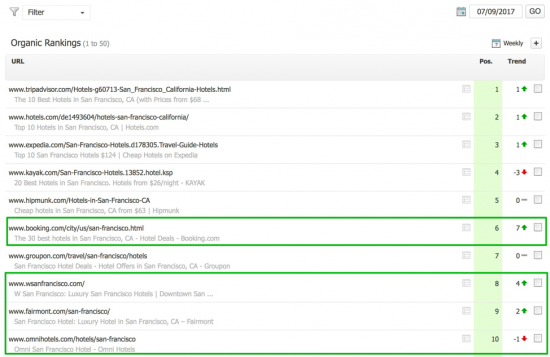

And now, 2017:

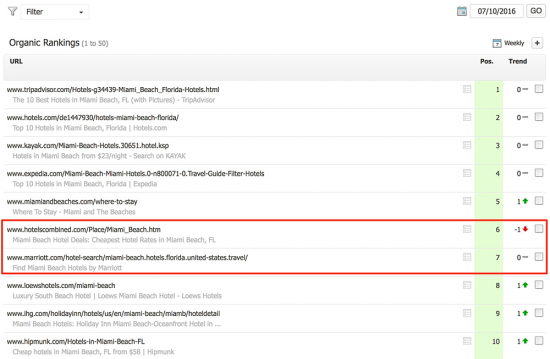

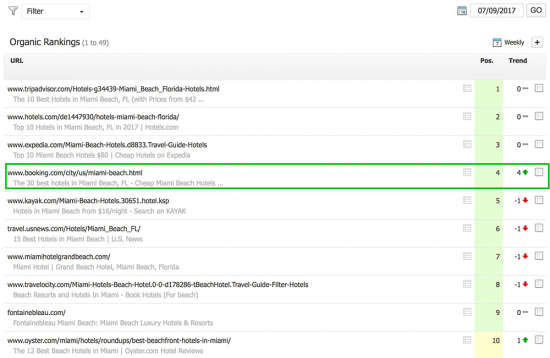

We can similar changes between 2016 and 2017 using the search term “Miami Beach hotels.” In 2016:

And 2017:

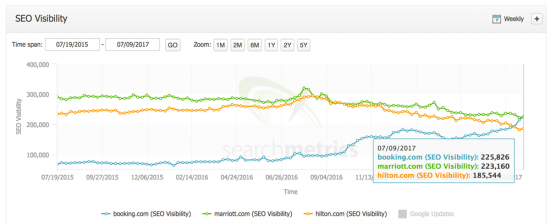

Looking at a few keywords and the top 10 rankings, hotelscombined.com, Hilton and Marriott used to have fairly high rankings. However, Google has been ranking them less well for many of these keywords, thus giving booking.com (and others) higher rankings for many more keywords. For both, Hilton and Marriott, their peak SEO visibility seems to have been in August 2016:

Including booking.com in the graph shows just how quickly it caught up to Marriott and Hilton, but also how quickly the two are falling:

Let’s not overlook the elephant in the room: booking.com is an aggregator, and aggregators that offer more than one product, deliver a great search experience and are trusted names increasingly rank much higher than individual brands. Our new Ranking Factors report on the travel industry acknowledges as much, but the report also offers tips and insights that everyone in the industry can use to rank well online.

No doubt, making sure you follow the latest SEO health trends is a must. But don’t forget that you also need to understand the search market on a more holistic basis – and you must understand that what was good for Google ranking a year ago may not be the same today, tomorrow or a month from now.