In our latest analysis, we’ve taken a deep dive into coronavirus-related topics such as travel, economic issues, and protection and prevention.

In short, we discovered people seem to prefer video rather than written content. As a result, YouTube gave users exactly what they are looking for, even on sensitive subjects.

As well as that, in accordance with E-A-T guidelines, Google continues to trust websites from official organizations and established news channels. This has allowed the UK and US governments and BBC and New York Times websites to continue to hold on to their positions in the top 10 rankings.

Detailed findings and our key takeaways are summarized below. To compare this current analysis to our earlier analysis, take a look at our April Google Trend Analysis.

Method

It’s important to keep perspective – given the ever-changing nature of the crisis, ranking data and search trends can only give a snapshot of the bigger picture. Our method revealed some trends but certainly not all of them.

Here was our method…

Rankings

We examined Google.com and Google.co.uk top 10 organic desktop results. We focused on domains appearing frequently on the first search results page for our set of keywords.

Google Trends

We started by using Google Trends to classify relevant pandemic topics. Even though this data only shows relative values between 0 and 100 points, it worked as a starting point for gaining insights into US and UK trends.

Topics

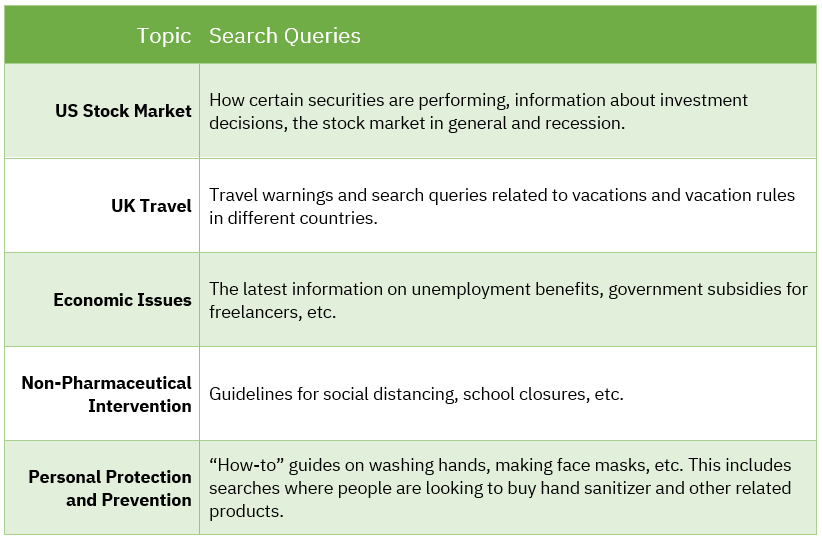

Like our April analysis, we included topics around coronavirus-related economic issues, non-pharmaceutical interventions, and personal protection and prevention, this time with an adapted keyword set to adjust to search demand.

We divided the topics into clusters and enriched them with related search query data This gave us a broader range of search results to analyze.

New keyword set in six subject areas with several hundred keywords. Data collected June 14, 2020.

Results

US Stock Market: YouTube Wins

YouTube saw the most top 10 rankings for keywords related to the stock market and coronavirus.

Marketwatch.com, a Dow Jones & Company, Inc. subsidiary, ranks second in our analysis. Marketwatch.com offers a slew of financial information, analysis and stock market data.

Cnbc.com was then third in the top ten and in fourth place is finance.yahoo.com.

UK Travel: Governments Win

In the UK, global travel warnings and contact restrictions caused a flood of searches about travel bookings.

Our analysis found that official, authoritative websites from the UK government and established news channels as the most trustworthy for search queries relating to holiday destinations, travel warnings and travel cancellation policies. This aligns with Google’s E-A-T guidelines.

Social media platforms are also well positioned – Twitter and Facebook scored high with quickly available, up-to-date information, placing them in the middle of the top 10 ranking, even overtaking well-established news resources such as The Independent.

Our analysis highlights the tough position tour operators are in – none appear in the top 10 rankings, having been pushed out by other sources of information.

US Economic Issues: Video Content Wins

YouTube has become even more important in comparison to our first analysis, now taking the top spot.

Our analysis reveals that Google is giving increasing trust to YouTube on sensitive topics such as economic issues.

Thebalancecareers.com remains in second place in the rankings, while forbes.com takes third place with a more general range of topics.

Surprisingly, the previously top-ranked business news channel CNBC has dropped to as low as sixth place.

UK Economic Issues: Government Websites Win

As in our first analysis, UK government websites top the national rankings on economic issues, further underpinning the importance of official sources of information on sensitive financial topics.

In contrast to the US rankings, there were no noteworthy changes in the UK.

US Non-Pharmaceutical Intervention: Social Media Wins

Compared to the data collected in April, social media continue to gain importance by providing users with daily news updates.

YouTube and Twitter continued to occupy the first two positions. Facebook made massive gains and has now taken third place.

The rest of the top 10 ranking are made up of the websites of established news channels such as CNN and the NY Times.

Interestingly, the Washington Post website is no longer in our top 10, despite ranking third in April.

UK Non-Pharmaceutical Interventions: YouTube Overtakes Government Websites

In the UK, traditional news channels and government websites remain at the forefront for non-pharmaceutical interventions, although YouTube has gained significant ground.

Despite being in last place in April, YouTube has quickly risen to second place, overtaking even the UK government websites.

Protection and Prevention: “How-To” Content and E-commerce Prevail

As we found in our April analysis, keywords relating to personal protection and prevention measures can be divided into two main subcategories:

- People looking for “how-to” guides on washing their hands, making face masks, etc.

- People looking to buy products like face masks, hand sanitizer, etc.

Google continues to rate YouTube’s diverse “how-to” video guides for making protective equipment and giving demonstrations (of how to wash your hands properly, for example) as particularly relevant, rewarding the video platform with the top spot.

After YouTube, we find major online retailers such as Amazon, Walmart and Target.

Healthline, which was previously at the bottom of the list, has risen to third place, increasing from 1.5% to 3%. Healthline has been producing a wide range of content over the past few months as part of its new “Coronavirus 2020” segment, which seems to be what grabbed Google’s attention.

Conclusion: Behind Every Crisis There Is an Opportunity

In a global crisis such as the corona pandemic, it is important for companies to constantly learn how to develop workflows in response to rapidly changing circumstances and, more importantly, to seize the opportunity to use the increased traffic and new customer contacts even beyond the coronavirus crisis.