In the article series “Big Data in SEO”, I will be covering the seven topics that are important to enterprise SEOs. This part deals with monitoring competitors with the Searchmetrics Suite.

Large companies are often surprised to learn that the biggest threating competition on the Internet is usually not from competitors having the same business model. On the contrary, publishers benchmark themselves with major portals such as Wikipedia. Shops turn up in the same search results as price comparison sites – with their own products. Pharmaceutical companies have to contend with online pharmacies for the best rankings.

In addition, once the competition has been identified on the SERPs, it still does not mean that the job is being done right if people try everything to get around it. After all, not every visitor who arrives via the organic or sponsored search results pages also becomes a customer too. Those who are familiar with conversion-heavy keywords and who keep their eye on the competition in order to learn from them do the job best.

1. An initial overview of the competition

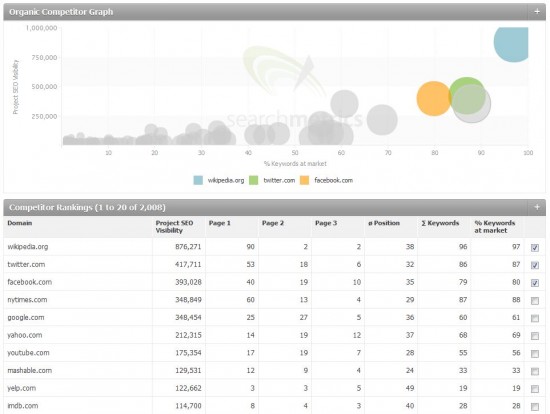

The research module of the Searchmetrics Suite provides a first glance at the competitor’s situation. Here, we analyze the domains that turn up in the same SERPs as well as your own domain:

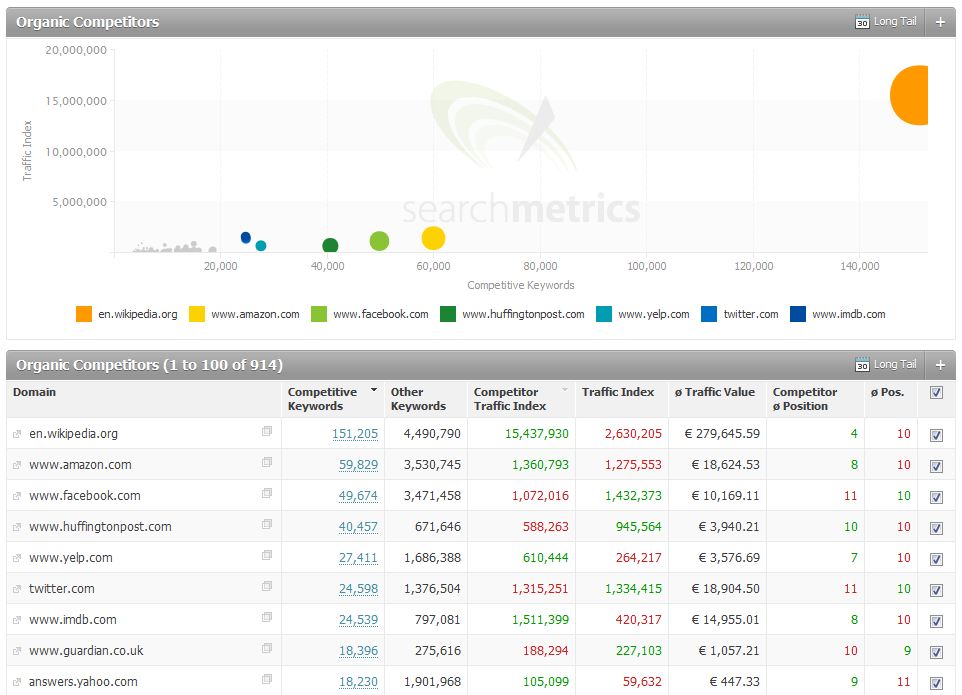

The screen quickly makes it apparent what the competitive climate of the New York Times is. At a glance, it is clear that the other U.S. magazines are fighting less for these same keywords than big sites like Wikipedia, Amazon and Facebook. The x-axis of the graph represents the number of “shared” keywords and the Y-axis represents traffic index, i.e. how much traffic the respective page receives from the perspective of the position and traffic volume. The table below the graph shows numerous detail values such as the average position within the analyzed keywords. For example, IMDB has to compete with the New York Times for relatively few keywords but ranks ten on average for these keywords. An excellent figure! Every SEO should see how they do that here…

2. Competition in the market environment

Now let us zoom in a little closer, because the totality of all keywords for the domain is found, it does not necessarily have to be the “ideal market”. It also, of course, has to be possible to compare specific horizontal portals and vertical platforms.

The suite data makes this as easy as it is fast. Our competitive analysis can also be based on defined keywords. Exact keywords essential for business success and that are worth monitoring are defined in each project. These can be categorized with tags and then used as the basis for all detailed project analysis such as a relevant competitor comparison:

Here you can see the competitor rankings of the benchmarks. There are also several other details: The table below the graph shows the respective competitive situation on the relevant search results page. Thus, in this comparison (again, New York Times) IMDB is not a very great competitor, but does yield relatively good results. The SEO of the New York Times should take a look into what keywords these are…

3. The direct comparison

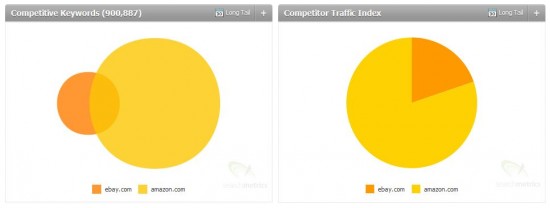

Now let us zoom in even a bit more. What data needs to be monitored if one would like to compare two domains with each other? A great many, of course. For this reason, we have compiled a comprehensive report with as many of these as possible and in the easiest way possible:

The domains under comparison illustrate that we do not need to fear large volumes of data. It is even possible to perform a very informative comparison between eBay and Amazon. Even when considering the entire depth and breadth of eBay, Amazon is still much, much bigger – and even has a better average keyword-position of 17 (of the 50 monitored positions). If one compares the historical curves, several similarities emerge such as the shared rise in mid-2011 or the simultaneous crash at the end of last year. However, as eBay SEO, I would ask myself which measures Amazon took to return to the original curve – and why I did not succeed at this.

And those were just the overall figures for the direct comparison of two portals. The other question is of course how “much” competition lies in the other. Or, in SEO Big Data terms: How many keywords are we fighting each for to gain the top rankings? And who is winning this fight? This is exactly what this chart illustrates better than 1000 words:

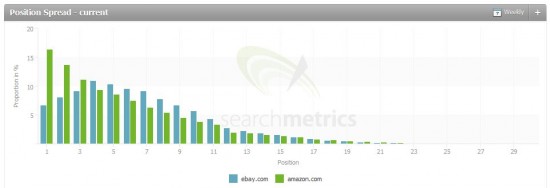

Of course, there are also direct comparisons in the paid index, i.e. where AdWords is used with an expenditure and success of varying degrees. The distribution of the ads is particularly impressive:

Here it is clear that Amazon is far ahead in the PPC discipline as well. While most of eBay ads are in fourth, Amazon ads are usually placed top.

4. What is the competitor doing?

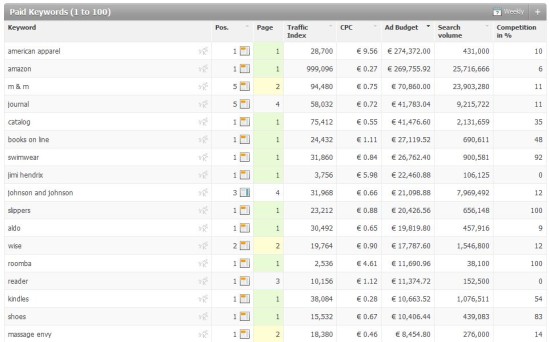

Of course, it is also possible to identify a direct competitor in the individual data of the domain in addition to more in the other parts of the big data series, which deal mainly with the analysis of one’s own side – but which can also be made a rewarding pursuit for competitors. What is interesting about the example above is the ad budget for the top keywords in the paid index:

The largest items are brand ads! Amazon therefore risked a high monthly expenditure for this – even more than the top position in the organic index. Other retailers and brand operators should think about this.

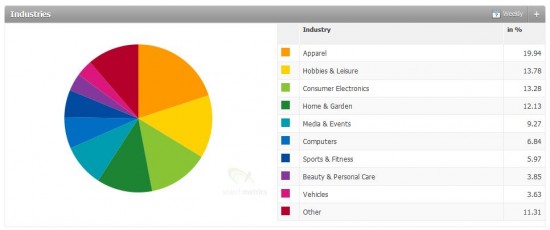

Or, because the PPC range is very easy to influence in contrast to organic index, an industry analysis of the AdWords ads makes it evident, for example, which industries a company uses. The Amazon overview again here:

Apparel is the industry that sees the highest sales at Amazon. I probably do not have to explain what this means for shops specializing in “fashion” or “shoes”.

Learn from the best: Big Data compared to the competition

One of the strengths of Searchmetrics Suite is that is shows the large number of detailed individual data items in such a way that very specific knowledge and actions can be developed as a result. After all, this is exactly what makes “Big Data” so valuable for enterprise SEOs: to take a huge pile of numbers and turn it into comprehensible, operational information.

Next week we will show you more about: Pick the cherries: tapping into hidden potential.

Series: How top companies handle big data in SEO

On our website you can get the complete Big data-series as complete eBook. Download now!

- Promoting productivity: managing international teams and agencies. Large quantities of data require a very fine allocation of rights. For reasons of data protection on the one hand, but also for quality reasons: If everyone can do whatever he or she wants to, you end up not really knowing what’s inside the big data pot. The Suite allows you to perform these tasks in a simple and user-friendly way thanks to the allocation of rights.

- Quick overview: managing different campaigns in a structured way. Large companies always pursue multiple goals at one time. These goals can be pursued individually using the features of the Searchmetrics Suite, such as tagging and multi-tagging. But the Suite also lets you adapt and automate every report and every chart.

- Observing competition: learning from your competitors. Competition is sometimes the biggest surprise in online marketing. Our offline competitors are potentially only marginal online competitors, whereas our offline partners are actually our toughest competitors. We provide just the right environment in numerous data pools.

- Pick the cherries: tapping into hidden potential. It’s not always worthwhile to work on the keywords with the largest number of searches. Competition, universal search and existing ranks also play an important part.

- Improving performance: technical optimization. Sometimes even the best SEO gets muddled up when dealing with a large page. We crawl every page and report error pages and optimization potential for keywords.

- Return on investment: paying attention to the conversion. Ultimately, it’s about the money. Is a PPC campaign worth it or would the budget be better allocated to SEO optimization. What’s more worthwhile? We supply figures to help you make this decision.

- Optimizing processes: saving time and money. One employee on the team needs a daily report, another one a monthly summary. Our reports are highly flexible, relevant and can be generated with just a few clicks.

So you see: There’s a lot to be done. Big data isn’t just marketing hype or a simple glance into a crystal ball filled with data. Big data is a necessary and effective way of working that is simply part of enterprise SEO and has to be learned. We help you with it. Stay tuned!